Caroline had worked in finance earlier in her career, and bankers have a f*@# you number, which is the amount of money you need to have before you quit your job and walk away. That FU number can be high and seems insurmountable.

In this lesson, we jump right into four strategies to achieve FIRE, only one of which is the FU Number (we dubbed it the Magic Number to keep the course G-rated!). We outline all four strategies right away so that you don’t fall into the same trap that we did – thinking it’s too hard and therefore missing opportunities around you. (continued below)

We confessed in lesson 1 that we didn’t get serious about FIRE till age 40. One big reason why we were so late to the party was that we assumed there was no way we could do it. We lived in a very expensive city, spending over $10,000 per month and didn’t feel like we were being wasteful. Childcare was several thousand, housing was several thousand, and these costs are every month. Taxes are also really high in New York City, so half of your paycheck goes to taxes once you add state and local to the federal tax burden.

We assumed the Magic Number strategy was all there was and missed opportunities in our first 20 years to develop multiple income streams, to start a money-making passion business, to geo-arbitrage (New York City has so many micro-neighborhoods you can do this within the same city), and to just think differently and get started sooner.

Don’t make the same mistake we did and waste time unnecessarily.

We stumbled onto these four strategies through trial and error and ended up using elements of all of them to reach financial independence.

Reflect on: What assumptions are you making about achieving financial independence? Are these beliefs helping or hindering you? Have you considered all four of the strategies we outline in this lesson? Which strategy or strategies resonates most with you?

Transcript:

Welcome to Module 1, Lesson 2 – The Four Main Strategies To Achieve FIRE.

Extreme saving, or extreme frugality, is exactly what it sounds like. You live off a very small portion of your income, 30% or less, and you save the rest. Over time, your savings creates enough of a nest egg that it can cover your thrifty lifestyle.

Let’s use someone who earns $100,000 a year and lives off $30,000 – a 70% savings rate and $70,000 added to savings each year. After 10 years of doing this, you would have $700,000, and if you withdrew 4% of that each year, you would have $28,000 of cash flow each year, almost enough to replace your $30,000.

You might hear this example and think, “But I don’t make $100,000 per year” or “I couldn’t live on $30,000” or “What about taxes?” or “How do you know you can safely withdraw 4% each year and never lose your principal?”. Yes, there are several assumptions baked into this extreme saving example because it’s an example. But if you look at the FIRE blogosphere, this is actually a very popular strategy so people have done it.

We dismissed Extreme Saving for a long time because we live in a high cost of living city (New York) and have two kids. We didn’t even consider this strategy, and in hindsight, we lost a lot of time unnecessarily, which we’ll explain later when we walk you through how we customized each of the strategies to make our own. For now, just keep an open mind.

There’s a lot to like about Extreme Saving. It’s accessible to everyone. There’s nothing complex or fancy about it. If you can get your expenses to be a small fraction of your income, eventually you will hit FIRE.

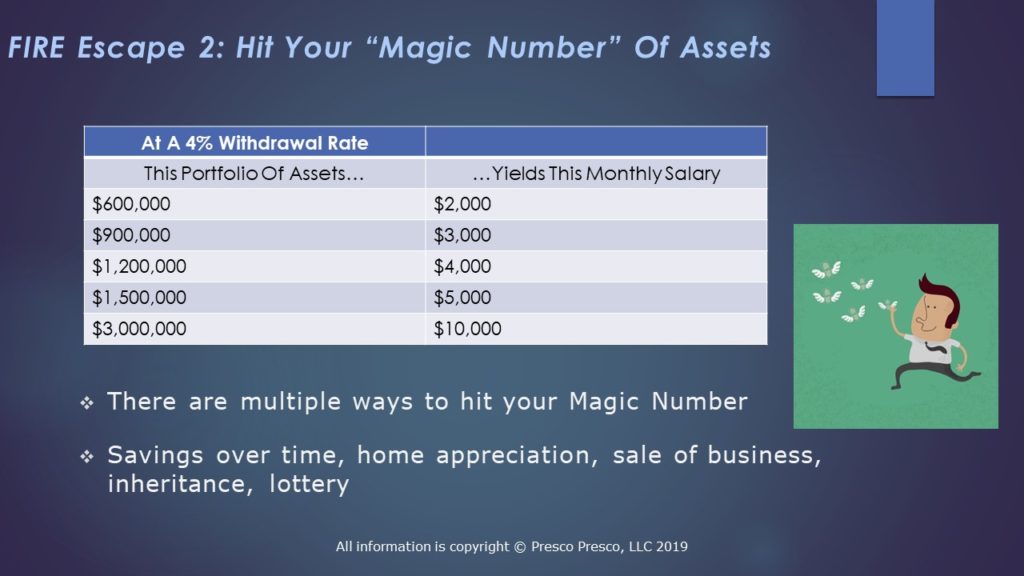

Hitting your Magic Number of assets is the second FIRE strategy. My first job was in investment banking, and in those circles, we said something much cruder than “Magic Number” but essentially it’s the same idea – what pile of money would you need such that you would walk into your boss’ office and say, “I quit” (again the banking version is much cruder).

The Magic Number strategy starts where Extreme Saving leaves off. It leapfrogs to that pile of money from which you could withdraw 4% of it and never touch the principal. The “4% Rule” is a mainstream money management rule of thumb based on the historical returns of the stock market after inflation. Based on historical returns, you could take 4% out of a broadly diversified investment portfolio and never outlive your principal in 95% of cases. The 4% Rule has come under question recently, but it’s still widely accepted, and if you prefer you can calculate your Magic Number using a 3% withdrawal rate or 2%. The idea is the same.

Where the Magic Number strategy differs from Extreme Saving is that it doesn’t assume you save your way to your number, or that you live frugally. Your Magic Number doesn’t care. It’s the amount of money you need to amass based on how much you want to spend each year and your withdrawal rate (the chart in the slide uses 4%).

How you amass that money can be by saving it, or it can be by selling a house with lots of equity, inheriting it, selling a business you built over time, winning it in the lottery, getting a big bonus at work, etc.

Think of all the tech start-up millionaires – not just the famous founders, but the early employees who cash out their options if the start-up has a successful exit. Some may go back into another start-up, but some might take their newfound riches, pull up stakes, and simply live off the portfolio.

The Magic Number was the first FIRE strategy that occurred to us, and we narrowly focused on it to our detriment. It’s easy to grasp but hitting the Number can be very intimidating, and it can blind you to other things you can do to achieve FIRE. For us, it kept us hostage to traditional jobs – our 401k savings were going to eventually be our Magic Number.

If you have never thought of your Magic Number, we strongly recommend calculating it. It forces you to look at what you’d like to spend and one way of getting there. But it’s not the only way, so don’t worry if your Magic Number scares you – like it scared us.

Your Magic Number is when your money makes money for you passively. You earn via dividends, interest, or capital appreciation, not your time or labor. But stocks, bonds, bank accounts, and other paper assets aren’t the only way to generate passive income. And building passive income sources is FIRE strategy #3.

Rental real estate is another example of a passive income source. You buy a property and rent it out, and money comes each month. If you have a property manager look after it, it’s a pretty passive investment (of course, you have to manage the manager, like you have to manage your money portfolio but it’s not as active as working a job).

A business that runs itself is another example of a passive income source. You probably have an entrepreneurial friend who has set up an online store to sell actual products, like clothes or cosmetics, or to sell online products, like training courses. Once the store is set up and has traffic, that income comes to you like rent from real estate. You can hire a store or website manager like you would a property manager. Your income is untethered from your time or labor at the store.

Royalties or license fees are income you collect multiple times over on work you’ve done once. When I wrote my book on career change, Jump Ship, I received an advance for writing it – that’s like a project fee, or time-for-money work. However, I also get paid every time a book sells.

Passive Income Sources are a broader way of thinking about your Magic Number. Like your Magic Number of assets, your Passive Income Source lives outside of your job. But you don’t have to rely on an investment portfolio. Your Passive Income Source can be a business of some kind or real estate. It can be something you tinker with along with other things, even your day job.

We all know people who have money but stay incredibly busy – Warren Buffett, for example. We don’t know him personally but he doesn’t seem to be working because he’s interested in the money. He’s already pledged to give most of it away. He loves what he does. So a legitimate FIRE strategy, and the 4th FIRE Strategy we’re sharing today, is to navigate your career so that you’re doing exactly what you want on your terms, and work becomes play.

Maybe it’s because we live in NYC, which is very Type A, 24/7 hustle, but even though we enjoyed our roles and industries, the corporate culture was a grind. Daily commutes, short vacations frequently interrupted by work, the insecurity that comes from relying on an employer. So even if you already love your job , you still benefit from achieving FIRE so you can love your job but not need it (isn’t that the healthiest of relationships?)

This might be working more flexibly – being able to work remotely or to work part-time. Being a digital nomad, traveling and working, might be enough of a shift that you feel retired even if technically you’re not. We both still work, but on passion projects that interest us.

One of my favorite books was “Room to Read” by John Wood, a senior executive at Microsoft who felt a calling after a trip to Nepal, quit his job and founded a non-profit to fund libraries in developing countries. He’s still working but was able to align his work with his mission. He didn’t take too much of a drop in lifestyle because he had some Microsoft money.

This fourth strategy, Building A Career That Doesn’t Feel Like Work, enables you to achieve the FIRE lifestyle now without necessarily achieving FIRE by the numbers. You don’t feel obligated to work – it’s a calling because you’re doing what you truly want. Yet, you don’t have to wait till you have x-amount of money in the bank or in passive income sources because you’ll be working.

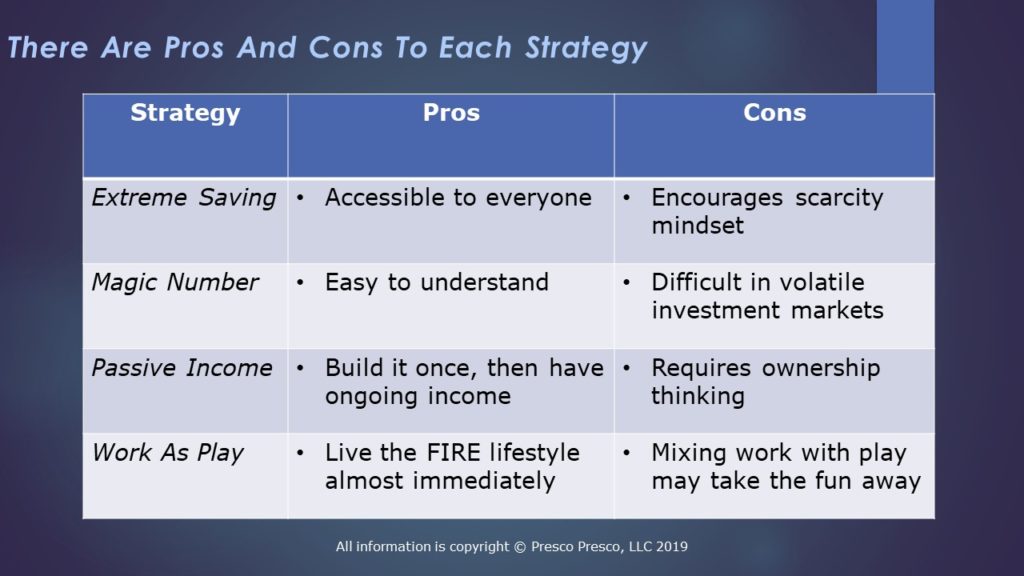

There are pros and cons to each strategy. Extreme Saving is accessible to anyone, but the frugality it requires encourages a scarcity mindset. It also requires time to get to the point where savings overtakes expenses.

The Magic Number is easy to understand, even fun to play around with. But it can also be intimidating, and this notion of having a finite pile of money that needs to last you forever is tough in these volatile times.

Passive Income takes away the volatility of the Magic Number if you build it right. On the down side, you have to build it, and you have to embrace being an entrepreneur/ owner of this income source.

Work As Play, or building a career you never want to retire from, enables you to skip FIRE and just go after what you think FIRE will bring you anyway – freedom on how you spend your time, freedom from grinding. But, sometimes passions are better left as hobbies, and if you try to monetize them, it takes the fun away.